Trailer interchange insurance … crucial for the trucking business, but seriously undervalued by many. At BHI Transport Insurance, we’ve witnessed (yes, up close and personal) how pivotal this coverage can be in shielding businesses from hefty financial blows.

This niche insurance? It kicks in when companies are on the hook for trailers they aren’t the proud owners of. We’re gonna dissect and demystify trailer interchange insurance, so you get why it’s a non-negotiable for your trucking ops.

Ready? Let’s dive in.

What Is Trailer Interchange Insurance?

Definition and Purpose

So, let’s talk trailer interchange insurance… it’s the armor for trucking companies when they’re dealing with trailers they don’t actually own. Think of it as the crucial patch in the commercial auto policy quilt-covering that gaping hole for non-owned trailers.

Coverage Details

Here’s when this insurance struts its stuff: when you’re hauling someone else’s trailer under a trailer interchange agreement. It’s like a safety net for physical damage that happens while the trailer is in your clutches (whether it’s hitched to your truck or parked somewhere). We’re talking accidents, theft, fires, Mother Nature flexing her muscles… the whole shebang.

Picture this: you’re hauling a refrigerated trailer for another company and, boom, you get into a fender bender. That damage? Trailer interchange insurance swoops in to cover the repair costs. Without it? You might be staring down a bill that eats up tens of thousands of dollars. Ouch.

When It’s Necessary

Is trailer interchange insurance optional? Ha, not really. It’s usually a must-have. Those trailer interchange agreements often demand it. If you’re in the game with intermodal containers, doing the Amazon Relay hustle, or operating under the Uniform Intermodal Interchange and Facilities Access Agreement (UIIA)-you’re probably on the hook for this coverage.

UIIA wants you covered for comprehensive and collision, plus fire and theft. And most UIIA EPs have a thing for trailer interchange coverage. Amazon Relay demands Auto Liability Insurance of $1,000,000 and Motor Truck Cargo Insurance of $100,000. No small potatoes.

Financial Considerations

What’s it gonna cost you? Trailer interchange insurance-super variable in pricing, anywhere from $100 to $1,500 annually. What jacks up the price? Your location, your claims history, and the coverage limit you pick. Seems like an added expense, sure. But think about this: the average commercial trailer costs more than $50,000. Paying out of pocket? Could cripple a lot of trucking ops financially.

(Heads up-BHI Transport Insurance might save you up to 20% compared to other providers… Not bad, especially if you’re running a small to medium-sized fleet.)

Distinct from Other Coverages

Don’t confuse trailer interchange insurance with non-owned trailer coverage or cargo insurance. It’s its own beast-specifically tuned to shield you when you’re handling somebody else’s trailer. Getting the right coverage? Not just ticking off a checkbox on contracts; it’s about safeguarding your business from drowning in financial quicksand.

So, let’s dig deeper into how trailer interchange insurance can be your business’s guardian angel, offering specific protections and benefits when you’re rolling with non-owned trailers.

What Does Trailer Interchange Insurance Cover?

Physical Damage Protection

So, let’s break this down-trailer interchange insurance is the lifeline for trucking companies when they’re dealing with someone else’s trailer. We’re talking all sorts of physical damage here, from minor dings to major wrecks. And, it doesn’t matter if the trailer is hitched to your truck or hanging out solo. Repair costs for commercial trailers are not pocket change, making this coverage a no-brainer.

Comprehensive Coverage

But wait, there’s more. This insurance isn’t just about collisions. It’s the Swiss Army knife of coverage, dealing with: Theft, Fire, Vandalism, Natural disasters (think floods, hurricanes, and the like).

You can’t predict life on the road or what happens at a job site-it’s chaotic.

Liability Considerations

Some policies throw in a dash of liability protection for trailer-related snafus. This could be your saving grace if you’re on the hook for damages caused by the trailer while it’s under your watch. (But, hey, don’t think this replaces your general liability insurance.)

Policy Limits and Deductibles

Now, let’s talk money. When you’re shopping for a policy, you’ve gotta look at coverage limits and deductibles. Most policies hover between $20,000 and $30,000. But, shoot-it can go higher. For example, Amazon Relay requires auto liability insurance limits of $1M per occurrence and $2M in aggregate. Deductibles-those sit between $1,000 and $2,500 typically. Higher deductibles usually mean lower premiums, but do a sanity check to make sure you can handle that hit if it comes.

Additional Benefits

And here’s a juicy tidbit-some insurers throw in goodies like proactive claims support to help you wade through the murky waters of the claims process. Super handy when you need to hit the road again, ASAP.

Trailer interchange insurance is a cornerstone of your business’s risk management game plan. Knowing the ins and outs-and tailoring your coverage to your specific needs-keeps your operation humming, even when Murphy’s Law strikes. So, what’s the deal with how this insurance plays out in the real world? Let’s dive in.

How Trailer Interchange Insurance Works in Practice

The Foundation: Trailer Interchange Agreements

First off, trailer interchange insurance is built on the foundation of trailer interchange agreements. These legal docs? They lay out who’s on the hook when you’re hauling someone else’s trailer. We’re talking specifics – liability for damages, duration of the interchange, and mandatory insurance coverage.

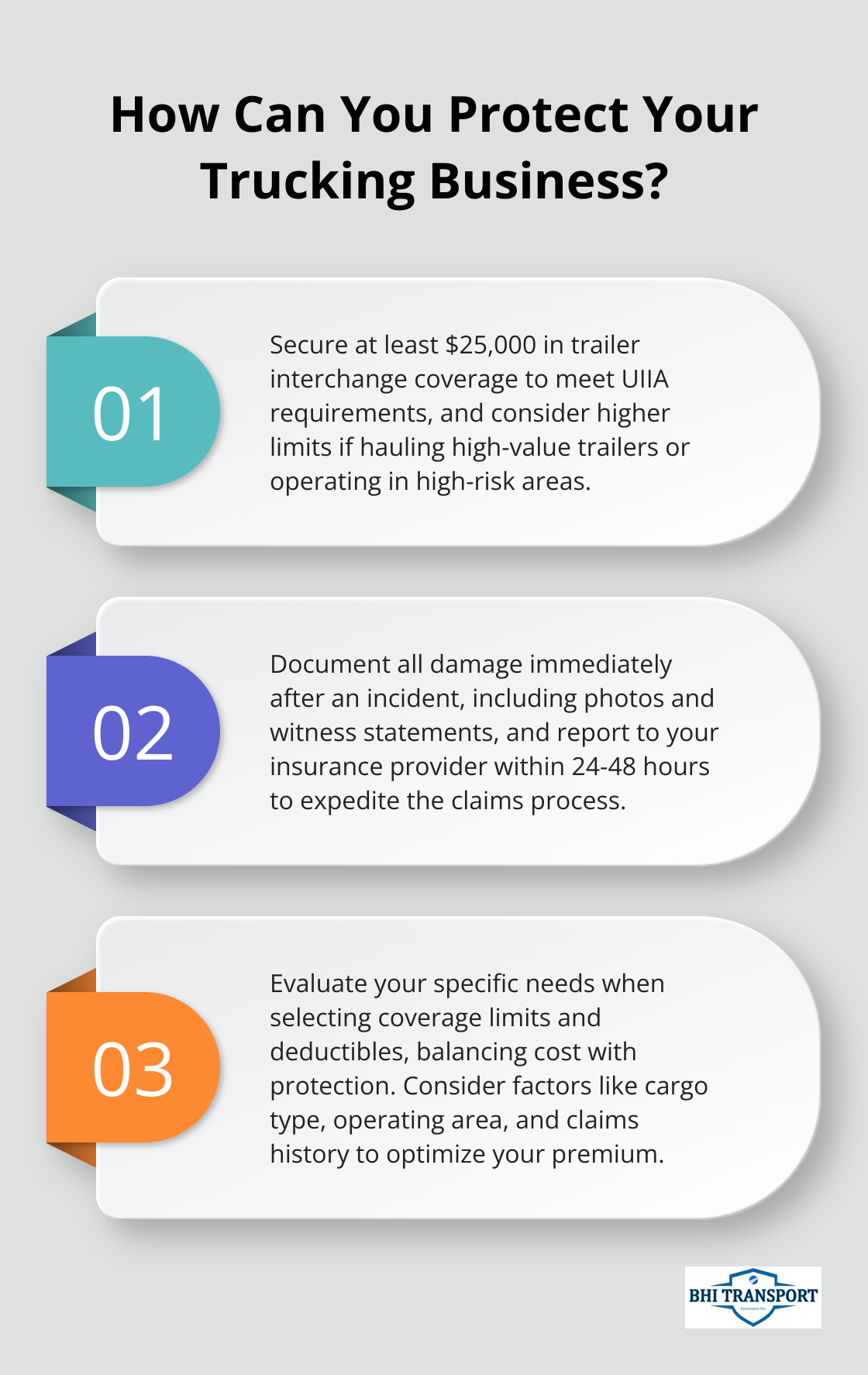

Enter the Uniform Intermodal Interchange and Facilities Access Agreement (UIIA), which rolls out very specific insurance requirements. Fast forward to 2024, and all UIIA participants? They’ve got to carry at least $25,000 in trailer interchange coverage. Many agreements require at least this amount.

The Claims Process: A Step-by-Step Guide

When the road gremlins strike and an accident happens, it’s claim time. And wow, this can be a bit of a maze. But knowing the ropes helps grease the wheels to get your payout faster.

- First thing’s first – document everything. Snap photos of the damage, collect those witness statements, and even file a police report if you must. (Timing is everything – many policies insist on damage reports within 24-48 hours.)

- Speed dial your insurance provider. They’ll handhold you through the next steps:

- Fill out a claim form

- Toss in your damage documentation

- Fetch repair estimates from approved vendors

How long to settle a claim? Buckle up – it varies. Simple claims could wrap up in days, while tangled messes might stretch to weeks or months.

Factors Influencing Premium Costs

Your premium? It’s not just pulled out of thin air. Several dials and levers affect how much you’ll fork over:

- Coverage limits: Push those limits higher, and yep, your premiums follow. Most policies sit between $20,000 to $30,000, but some shoot to $100,000 or beyond.

- Deductible: Bigger deductible? Smaller premium. Common deductibles? Think $1,000 to $2,500.

- Claims history: Keep it clean, and your wallet stays happier. One major glitch could bloat your premium come renewal time.

- Cargo type: Got hazardous materials or pricey goods? Your premiums just got heftier – more risk, more moolah

- Operating area: Urban jungle with traffic jams and crime sprees? Pricier policies, naturally.

Balancing Cost and Protection

Now, the cheapest? Usually not the smartest. You want that sweet spot between cost and coverage. A solid insurance provider can help you thread that needle.

Not hauling high-value trailers all the time? Maybe a lower coverage limit can trim your premium. But – and it’s a big but – make sure you’re not skimping on the protection you actually need. Choose wisely, and roll safe.

Final Thoughts

Trailer interchange insurance – sounds like a mouthful, right? But seriously, it’s a lifeline for your trucking business, keeping you from financial chaos when stuff hits the fan with those non-owned trailers. Accidents, theft, natural disasters… you name it, this coverage has your back. So, when you’re hunting for a policy, think hard about your needs – types of trailers, their worth, the risks on your routes. Balance is key.

First, take a look at your current setup. Review those trailer interchange agreements sitting in your file cabinet. Only then should you hit up a trusted insurance provider. These folks know their stuff and can untangle the complexities of this niche coverage, tailoring it to fit like a glove. BHI Transport Insurance? We’ve got you covered – literally. Drivers in Florida and Georgia, pay attention – you could save some serious dough.

Our policies aren’t just about ticking boxes. They’re comprehensive – covering myriad incidents. Plus, we offer proactive claims support, so your wheels keep turning, no matter what. Visit our website for the full scoop on how we safeguard your assets and bolster your success out there on the open road. Don’t wait for disaster to strike – secure your business’s future with the right trailer interchange insurance now.