Commercial auto liability… yeah, it’s a big deal if you’re running a biz in Florida. Miss the legal requirements, and BAM! Costly mistakes and even bigger legal headaches.

At BHI Transport Insurance, we’ve seen it all—businesses saved by the skin of their assets, thanks to proper coverage. Let’s cut to the chase: this guide is your lifeline for navigating the murky waters of commercial auto liability in Florida. We break it down so you can make the smart moves for your company’s future.

What Are Florida’s Commercial Auto Liability Laws?

So, Florida – the land of sun, fun, and really complex commercial auto liability laws. If your business has wheels on the road, you better know the rules. Why? To avoid turning that sunshine into financial rain (read: costly penalties).

Minimum Coverage Requirements

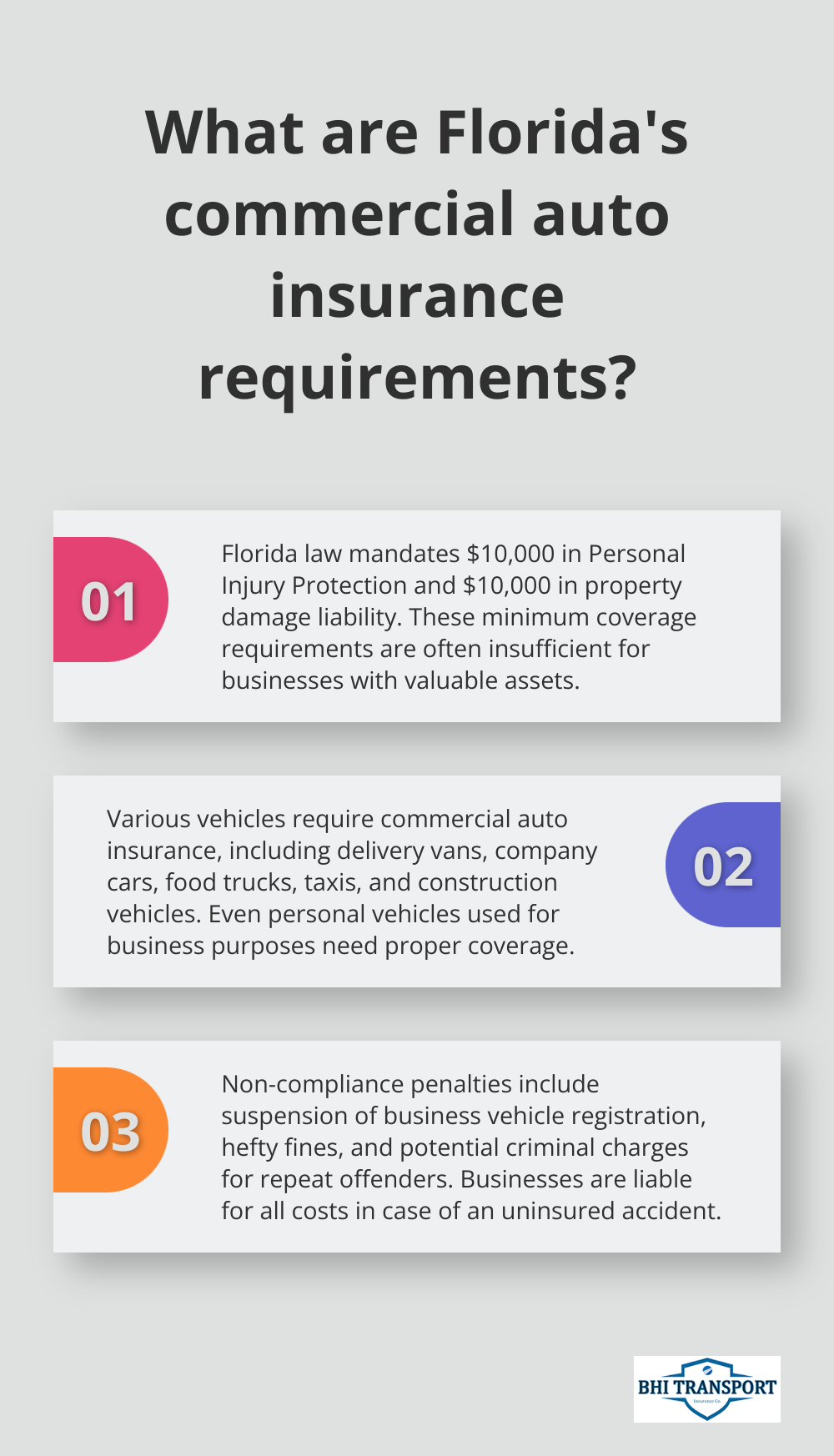

First off, Florida law mandates a starter pack of $10,000 in Personal Injury Protection (PIP) and $10,000 in property damage liability. But – and it’s a big but – these numbers are like bringing a water pistol to a five-alarm fire. The smart money says you need more, especially if your business has big rigs or valuable assets.

Vehicles That Need Coverage

This isn’t just about semis and dump trucks. Nope. See a business use in these?

- Delivery vans

- Company cars

- Food trucks

- Taxis and rideshare vehicles

- Construction vehicles

Even your trusty sedan doing double duty as a business car needs proper insurance. Miss a memo to your insurer? Denied claims and potentially being slapped with insurance fraud. Nobody’s got time for that.

Penalties for Non-Compliance

No coverage? Get ready for the DMV’s version of a root canal:

- Suspension of business vehicle registration

- Hefty fines that could empty your accounts

- Criminal charges if you’re a repeat offender

And if you crash without coverage? Well, businesses get the bill for everything – accidents, damages, injuries. That’s a quick trip to financial disaster-ville.

Special Considerations for Truckers

Got a truck? Federal law’s got an extra layer of fun for you. Think at least $750,000 in liability coverage for those crisscrossing state lines or doing any for-hire driving.

Staying Compliant

So, how do you keep your business on the up-and-up? Try these:

- Review your coverage limits often – like really often

- Stay in the loop on any regulatory changes

- Get advice from a reputable insurance provider (maybe BHI Transport Insurance) to keep things tailored and tight

Navigating Florida’s commercial auto liability landscape is like walking a tightrope in a hurricane. It’s complex, it’s changing, and it can be brutal. Now, time to dive into what really jacks up those insurance premiums in the Sunshine State. Stay tuned…

What Drives Your Commercial Auto Insurance Costs?

Florida’s commercial auto insurance market – much like its weather – is unpredictable and ever-changing. What dictates how much you’ll be shelling out? We’ve got a cocktail of factors here, and knowing them can help you dodge that financial lightning bolt. Let’s break down the ingredients impacting your business vehicle insurance rates.

Driver History and Experience

Think of your drivers as rolling billboards for your business. Their driving records? Yeah, those are your premiums. Florida drivers are feeling the pinch with premium hikes, even with squeaky-clean records. This is a wake-up call – keeping that record spotless is becoming a Herculean task.

One way to tackle this? Roll out a top-notch driver training program. It’s not just about following the rules – it’s about creating a culture of safety that insurance companies can’t ignore.

Fleet Composition and Value

Ah, the fleet. Size, type, value – all in the mix. A gaggle of luxury sedans? Prepare to empty your pockets more than for a convoy of economy cars. Specialized rigs like refrigerated trucks or hazmat haulers? Double whammy on risks and premiums.

When picking vehicles, think total cost of ownership. Sometimes, that pricier model with killer safety features can save you bucks in the long haul.

Business Nature and Risk Profile

What’s your gig? And how are your wheels grinding? The nature of your biz heavily colors your premiums. A pizza delivery operation cruising the streets non-stop? Totally different ballgame compared to a construction firm hauling tools to job sites.

Hauling long-distance? Brace yourself for higher premiums – exposure tax.

Safety Record and Claims History

Your claims history is like a GPA for insurers. Ace it with a clean sheet, and you’re gold. Stuff it with claims, and you’re a red flag. Safety programs, scheduled vehicle maintenance, and dangling carrots for drivers with zero accidents? These are your grades.

Getting a grip on these factors lets you get ahead of the cost curve for insurance. Stay tuned as we dive into how comprehensive coverage can shield your biz from a slew of risks, offering a safety net that doesn’t just stop at liability.

Why Comprehensive Coverage Is Your Business’s Safety Net

Comprehensive commercial auto coverage isn’t just some fancy add-on-it’s your business’s armor against the unexpected. This coverage can mean the difference between a minor hiccup and major financial disaster.

The Shield Against Third-Party Claims

Picture this: your delivery driver accidentally sideswipes a luxury car. Yeah, without comprehensive coverage, you’re looking at a potentially bankrupting lawsuit. With it? You’re protected. In 2022, the average auto liability claim for bodily injury was $24,211 (thanks, Insurance Information Institute). That’s a number that could sink a small business.

Nature’s Wrath and Your Bottom Line

If you’re in Florida, hurricanes and floods are just another Tuesday. In 2022, Hurricane Ian caused over $21 billion in insured losses (a chunk of that was vehicle damage). Comprehensive coverage steps in where basic liability craps out, covering everything from natural disasters to theft and vandalism.

Medical Expenses: The Hidden Budget Buster

Injuries… they sneak up on you. The National Safety Council says the average economic cost per death in a motor vehicle crash is a staggering $1,750,000. Even minor injuries can rack up tens of thousands in medical bills. Comprehensive coverage often includes medical payments coverage-helping to soften that blow on your bottom line.

Legal Battles: Leveling the Playing Field

Legal fees… they stack up faster than bad decisions at a Vegas wedding. The American Bar Association notes lawyer rates can range from $100 to $1,000 per hour. Without proper coverage, that bill’s coming straight out of your pocket. Comprehensive policies typically include legal defense costs, so you’re not David going up against Goliath in court.

BHI Transport Insurance offers policies addressing these real-world situations. Our comprehensive coverage for truck drivers in Florida and Georgia is a robust safety net, custom-tailored to your needs. We’re talking potential savings up to 20% and proactive claims support. It’s not just about coverage-it’s about genuine protection.

Final Thoughts

So, here’s the deal-commercial auto liability is your business’s armor in Florida’s chaotic ecosystem. We’re talking about serious protection for your assets, reputation, and future when life throws accidents or lawsuits your way. Over at BHI Transport Insurance, we’ve got your back with custom commercial auto liability coverage for truck drivers in Florida and Georgia-yeah, you could save up to 20%. Not bad, right?

Our plans? They don’t just sit around. They kick into gear for non-collision issues and accidents, fault be damned. We’re not in the business of simply selling policies-we’re in the business of selling peace of mind. Our proactive claims support? It’s there to untangle the messiness of incidents while you focus on what you do best-running that business and staying on the road.

Underinsurance-you might as well be uninsured. Just as risky. Go for comprehensive coverage that evolves with your business, especially in Florida’s ever-shifting commercial transportation scene. With the right plan, you can keep trucking along, secure in the knowledge your business is covered mile after mile.